non filing of income tax return notice under which section

Notice under this section is received after a detailed enquiry has been done by the assessing officer. There may be many types of discrepancies found in the ITR filed by you like concealment of taxable income claiming an in genuine refund non-filing of ITR etc.

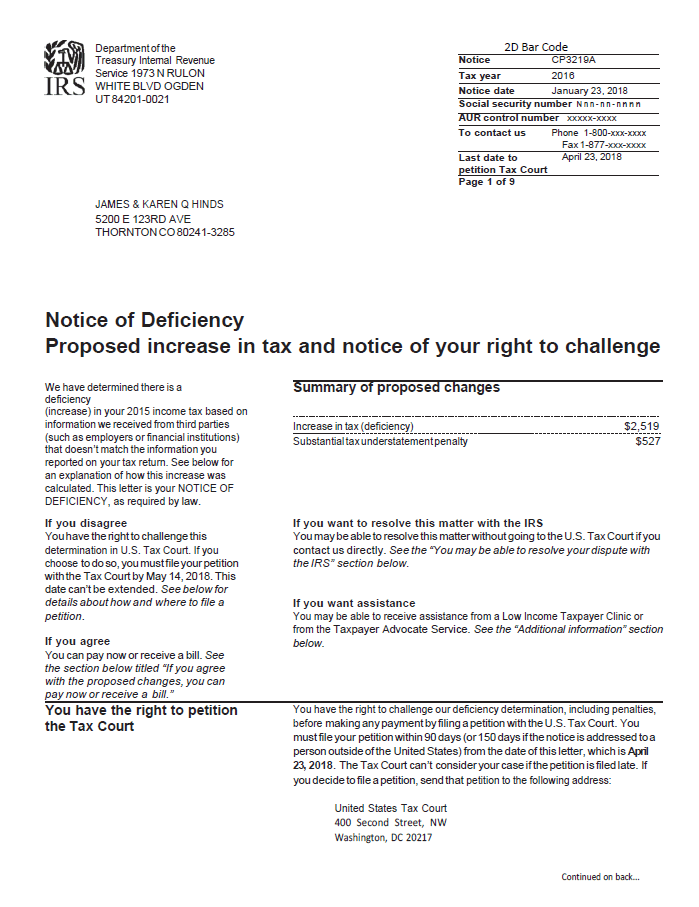

Notice Of Deficiency Overview Irs Forms Options

Section 156 This notice is about some dues which the tax payer owes to the department.

. For TurboTax Live Full Service your tax expert will amend your 2021 tax return for you through 11302022. Return under Preparation Business has been closed no taxable income others. File Belated ITR File your belated return in just 4 minutes.

File with us to win your taxes Ready to File. Make changes to your 2021 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10312024. Notice for Non-Disclosure of Income.

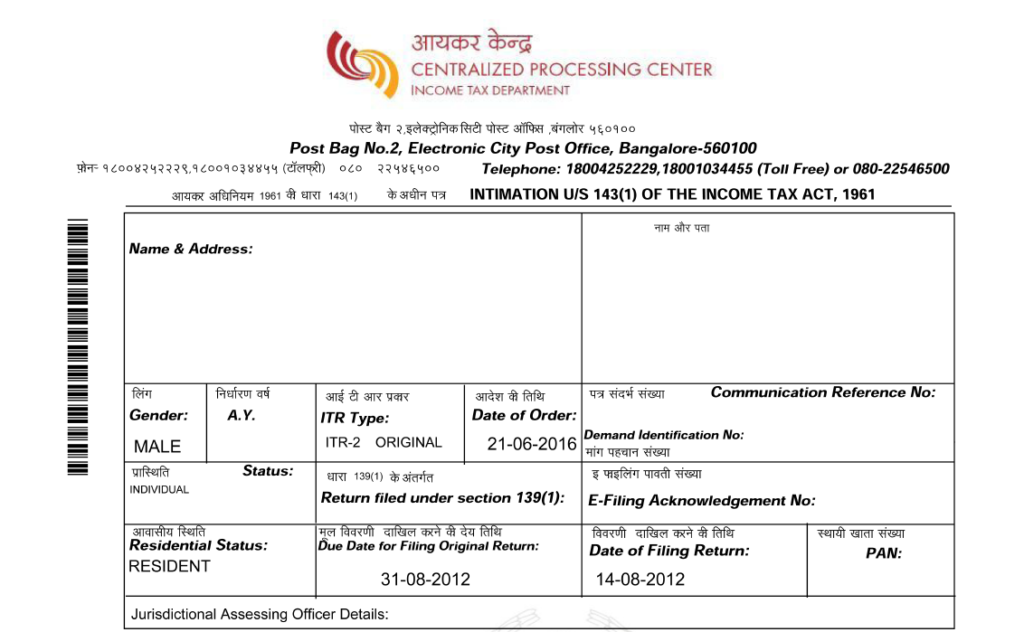

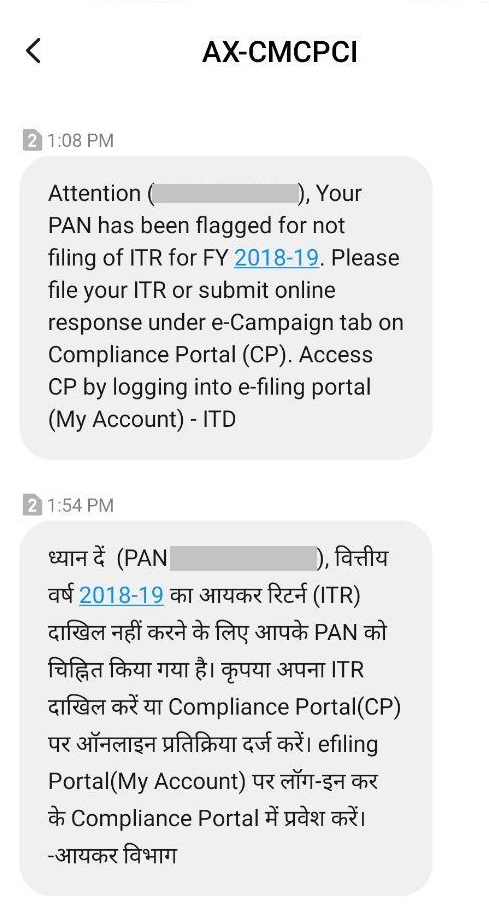

Click on View and Submit Compliance to submit your response to the non-filing compliance notice. Here you can view information about your non-filing status. In general the due dates prescribed by which individuals or entities are required to file their income tax returns are as follows.

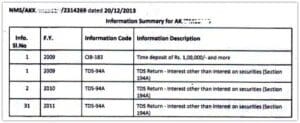

TDS in case of non-filers of Income Tax Return- Section 206AB of Income Tax Act. Failure to file the return of income in response to a notice issued under section 1421i or section 148 or section 153A. A new section 206AB has been introduced by the Finance Act 2021 which is going to increase TDS compliance burden of corporates and businessmen in a great manner.

Section 148 If the assessing officer feels some income has been missed a notice is sent under this section as the income will need to be reassessed. Section 273B provides that no penalty shall be imposed inter alia us271F where the assessee establishes a reasonable cause for failure referred to in said section. The Income Tax Department issues notices under section 139 9 143 1 143 2 143 3 245 144 147 and 148 of the Income Tax Act 1961 seeking the satisfactory answers in this regard.

If the taxpayer fails to comply with all the terms of a notice issued under section 143 2 Thus Non-Filing of the Income Tax Return may result in the Best Judgement Assessment. This section requires that the person payer who deducts TDS in case of a payee who is a non-filer of income tax. Section 139 of the Income Tax Act 1961 deals with the different kinds of returns that can be filed in case the person or the entity in question has not filed tax returns before the expiry of the prescribed deadline.

Notice for Non-Payment of Self Assessment Tax. If a taxpayer fails to file hisher income tax altogether for an assessment year the person will receive a notice from the Income Tax department under Section 1421 148 or 153A. 1 lakh upto 30-6.

You can find another option view my submission. Failure to file the return of income as per section 1391. Let us know about the amendment proposed by Finance Bill 2022 by Non filer of income tax return under section 206AB and 206CCA.

Have you filed your tax returns yet. If ITR is not filed even after these measures the concerned individual might face prosecution under Section 276CC of the Income Tax Act for tax evasion. Section 139 of the Income Tax Act 1961 contains various provisions related to late filing of various income tax returns.

If any individual or non-individual tax assessee has not filed tax returns within the specified deadline Section 139. Click on Compliance Menu Tab. Smart Simple and 100 free filing.

5 Claim of Refund of Taxes. You can reply to such a notice by following these steps- Login to your account on the website incometaxindiaefilinggovin Click on the Compliance Tab and then click View and Submit Compliance If you have not filed your ITR select the reason for the same ie. In the given facts ITAT find that there was a reasonable cause with.

You get a defective return notice under section 139 9 of the Income Tax Act. Notice for Tax Credit Mismatch. Notice for Delayed ITR Filing.

In order to widen and deepen the tax-base and to nudge taxpayers to furnish their return of income Finance Act 2021 inserted sections 206AB and 206CCA in the Act. Rigorous imprisonment which shall not be less than 6 months but which may extend to seven years and with fine where tax sought to be evaded exceeds Rs. Many taxpayers have received notice under section 1431a after filing their Income-tax returns for AY 2017-18 or AY 2018-19.

Gives you a period of 15 days to correct the mistake. If you do not file the income tax return in the correct form you will receive a defective return notice from the income tax department. Notice Under Section 1421.

Section 139 9 of the Income Tax Act 1961 states that when a return is found defective the AO. Notice for Non-Filing of Income Tax Return. This is an assessment carried out as per the best judgment of the Assessing Officer on the basis of all relevant material he has gathered.

Terms and conditions may vary and are subject to change without notice. So one should not get confused between the two. The return can be considered defective for one or many reasons as stated below.

Section 142 1 - Inquiry Notice before Assessment of Tax Income tax notice us 142 1 is sent to people to understand the reason why you have not filed the return or if you have filed then need to explain or furnish additional details. Now it is important to understand that notice under section 1431 and 1431a are two different notices and the way of dealing them is also different. Once received you need to respond to it within 15 days from the date of receiving the notice.

How To Respond To Non Filing Of Income Tax Return Notice

Irs Notice Cp503 Second Reminder For Unpaid Taxes H R Block

No Stimulus Check Irs Tells Non Filers To Check The Mail To Find Out How To Claim One

Irs Notice Cp80 The Irs Hasn T Received Your Tax Return H R Block

Irs Audit Letter Cp2501 Sample 1

How Should You Respond To A Defective Income Tax Return Notice

What Is A Cp05 Letter From The Irs And What Should I Do

Irs Notice Cp81 Tax Return Not Received Credit On Account H R Block

Irs Letter 1615 Mail Overdue Tax Returns H R Block

How To Respond To Non Filing Of Income Tax Return Notice

How To Respond To Non Filing Of Income Tax Return Notice

All About Notice U S 143 1 A And How To Deal With It Myitreturn Help Center

Irs Letter 4903 No Record Of Receiving Your Tax Return H R Block

How To Handle Income Tax It Department Notices Eztax

How To Respond To Non Filing Of Income Tax Return Notice

Understand Income Tax Notices Learn By Quickolearn By Quicko

How To Respond To Non Filing Of Income Tax Return Notice

Notice For Not Filing Income Tax How To Respond To It Learn By Quickolearn By Quicko

All About Notice U S 143 1 A And How To Deal With It Myitreturn Help Center