maine tax rates for retirees

If the taxable income is. Maine has a state income tax for any income you earn within its boundaries after living there for at least 183 tax days.

Top Ten De Paises Ideales Para Vivir Retirement Planning Places To Go Travel Infographic

Prior to January 1 2013 the graduated rates ranged from 2 to 85.

. Estates above that threshold are taxed as follows. Property tax exemption for seniors 65 and older or surviving spouses 50 of first 200000 in actual value exempt No estate or inheritance tax. 207 512-3100 PO.

The median property tax in Maine is 193600 per year for a home worth the median value of 17750000. 8 on first 3 million above the threshold. The previous marginal tax rates were replaced starting in 2010 with a flat tax of 65 of Maine taxable income.

Maines income tax rate ranges from 58 to a top marginal rate of 715. Employer Self Service login Call us toll free. Seniors who receive retirement income from a 401k an ira or a pension will pay tax rates as high as 715.

10 on the next 3 million. Benefit Payment and Tax Information In January of each year the Maine Public Employees Retirement System mails an Internal Revenue Service Form 1099-R to each person who received either a benefit payment or a refund of contributions in the prior calendar year. Payment Vouchers for the 2022 tax year.

Is maine a tax friendly state for retirees. States with no income tax seven states dont impose an income tax as of 2020. Maine tax rates for retirees.

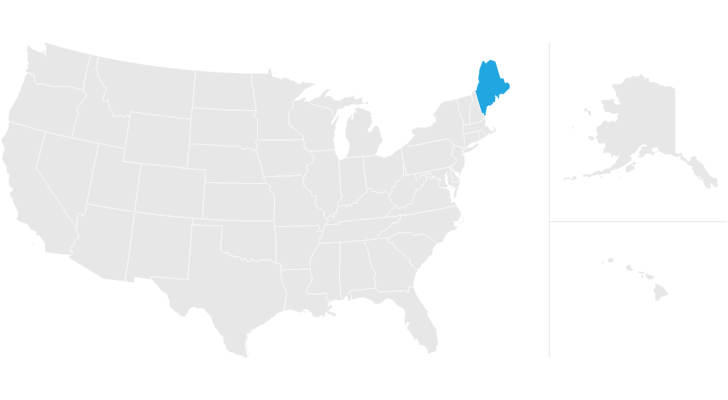

Although the good news is that Maine does not tax Social Security Income. Some states exempt all pension income and most exempt Social Security benefits. Click on any state in the map below for a detailed.

Flat 463 income tax rate. State tax rates and rules for income sales property estate and other taxes that impact retirees. The additional amount is 3400 if the individual is both 65 or over and blind.

At one time or another pretty much everyone approaching retirement or early in retirement. The Maine Public Employee Retirement System MPERS serves the public with sound retirement services to Maine governments. There are certain complicated situations that apply such as for annuities.

Box 349 Augusta ME 04332. Retirement distributions need to be reviewed to ensure a proper reconciliation with Maine law occurs. State tax rates and rules for income sales property estate and other taxes that impact retirees.

Download a sample explanation Form 1099-R and the information reported on it. Other states provide only partial exemption or credits and some tax all retirement income. For state income taxes virginia doesnt tax social security.

Current year 2021 forms and tax rate schedules These are forms and tax rate schedules due in 2022 for income earned in 2021. Individuals may deduct 10000 of pension income although social security benefits received reduce that amount. Less than 33650 58 of Maine taxable income 33650 but less than 79750 1952 plus 675 of excess over 33650 79750 or.

The tax treatment at the federal level of these retirement distributions is addressed in Pub 4491 Chapter 18 - Pension Income and on this site at Federal - Retirement Income. Counties in Maine collect an average of 109 of a propertys assesed fair market value as property tax per year. For deaths in 2020 the estate tax in maine applies to taxable estates with a value over 58 million.

Property taxes are also above average in Maine. Retirement income tax breaks start at age 55 and increase at age 65. Although the good news is that Maine does not tax Social Security Income.

The Maine state tax percentage ranges from 58 to 715 percent depending on your income and filing status. They also have higher than average property tax rates. Maine with a tax burden of just over 10 is the ninth highest in the country.

Social security income is not taxed. Military pensions are exempt. Maine Estate Tax.

If you retire in Maine you may be subject to state income tax. Maine is ranked number twenty out of the fifty states in order of the average amount of property taxes. The first step towards understanding Maines tax code is knowing the basics.

However Maines sales tax rate is considerably low at 55. See Maine Revenue for more. 109 of home value.

1 day agoThis proposal delivers direct inflation relief and ongoing tax relief for retirees while also investing in education property tax relief workforce. Estate worth increases to 5 million in 2021. Below we have highlighted a number of tax rates ranks and measures detailing Maines income tax business tax sales tax and property tax systems.

With that being said the low cost of living may be less relevant depending on how much money you have for your retirement. The rates ranged from 0 to 795 for tax years beginning after December 31 2012 but before January 1 2016. Maines income tax rate ranges from 58 to a top marginal rate of 715.

Maine has a relatively high overall state and local tax burden at 10 of income compared to a national average of 97 according to the Tax Foundation. State tax on social security. And 12 on all remaining value.

Each states tax code is a multifaceted system with many moving parts and Maine is no exception. 99 and 234 LD. Although the state does not tax Social Security income expect high tax rates of up to 715 on your other forms of retirement incomes.

Tax amount varies by county. For deaths in 2021 the estate tax in Maine applies to taxable estates with a value over 587 million. Average property tax 607 per 100000 of assessed value 2.

One of the downsides to living in Maine is the fact that the income tax and retirement income tax rate can be as high as 715. If you receive retirement income from a pension IRA or a 401k then you will be required to pay taxes as high as 715. How does Maine rank.

Oregon taxes most retirement income at the top rate while allowing a credit of up to 6250 for retirement distributions. 800 451-9800 local.

Maine Tax Forms And Instructions For 2021 Form 1040me

2015 S Best Worst States For Military Retirees Usmc Mom Best Retirement

Maine Sales Tax Small Business Guide Truic

Maine S Tax Burden Is One Of The Highest New Study Says Mainebiz Biz

Maine Estate Tax Everything You Need To Know Smartasset

Maine Retirement Tax Friendliness Smartasset

Which States Pay The Highest Taxes Business Tax Family Money Saving Economy Infographic

If You Want To Avoid Paying Lots Of Taxes You Might Want To Steer Clear Of The Northeast And Venture Towards Th Best Places To Retire Retirement Locations Map

11 Pros And Cons Of Retiring In Maine 2020 Aging Greatly

Maine Income Tax Brackets 2020

We Did It Mortgage Process Preapproved Mortgage Mortgage Brokers

Maine Retirement Tax Friendliness Smartasset

Military Retirees Retirement Retired Military Military Retirement

Maine Retirement Tax Friendliness Smartasset

Visualizing U S Stock Ownership Over Time 1965 2019 Investing Financial Wealth Chartered Financial Analyst

Ask Hannah Holmes Your Home Maintenance Questions Answered Home Maintenance Old Farm Houses Old Farm

The Best And Worst States For Retirement 2021 All 50 States Ranked Bankrate Clark Howard Retirement Best Places To Retire